Retirement Is Closer Than You Think — And So Is Your Next Move

For many homeowners, retirement is no longer a distant milestone. It’s becoming a near-term reality.

Over the next several years, thousands of Americans will reach retirement age every single day. A significant percentage are planning to step away from full-time work in 2026 and 2027. That shift is creating an important question for many households:

Does your current home still support the life you want in the next chapter?

For a growing number of homeowners, the answer is leading them toward one clear decision — downsizing.

Downsizing Isn’t About Losing Space — It’s About Gaining Freedom

There’s a common misconception that downsizing means settling for less. In reality, most homeowners who choose to move later in life aren’t focused on square footage. They’re focused on lifestyle.

The priorities often shift from “more” to “manageable.”

Many retirees and soon-to-be retirees are looking for:

-

A home that’s easier to maintain

-

Fewer stairs and more functional living spaces

-

Lower utility and upkeep costs

-

A location closer to family and long-time friends

-

The flexibility to live where they truly want

The goal isn’t to downgrade — it’s to simplify. A well-sized home can create more time, less stress, and fewer responsibilities tied to maintenance and repairs.

For many, that peace of mind is priceless.

Why Homeowners Over 60 Are Making a Move

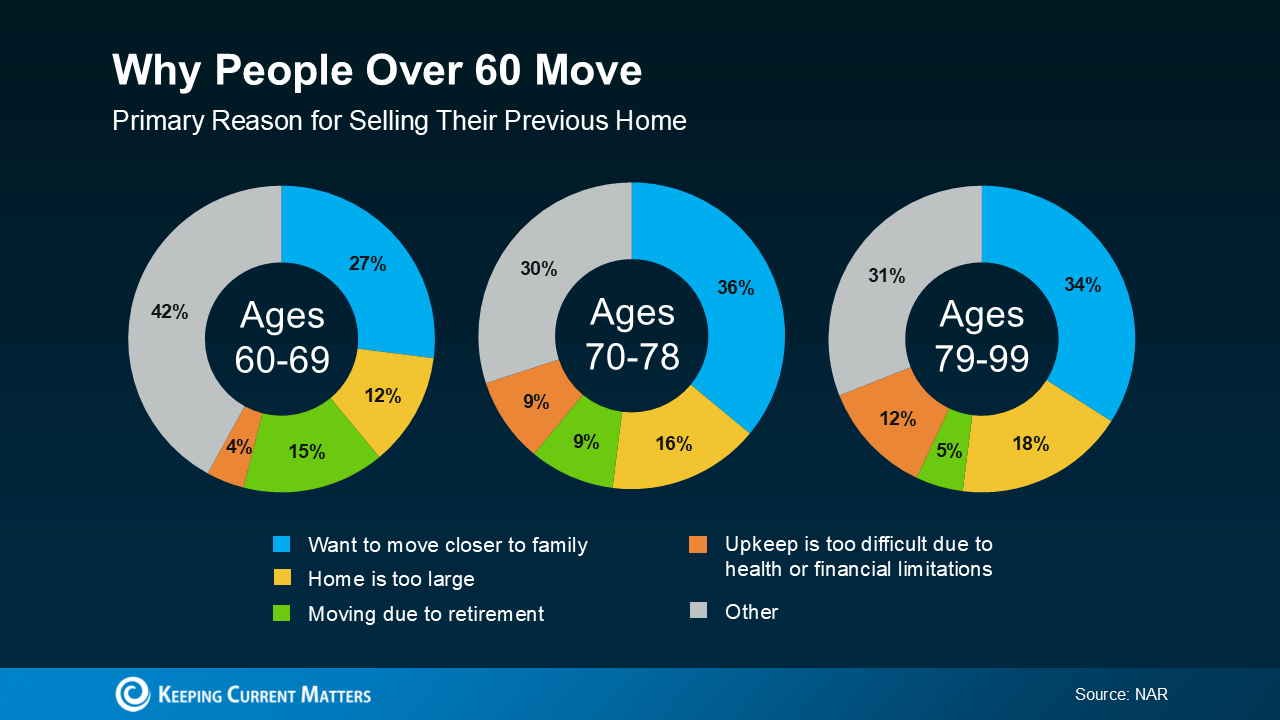

Data shows that lifestyle factors — not market timing — are the primary drivers behind moves among homeowners over 60.

The most common motivations include:

1. Being Closer to Family and Community

As families grow, proximity matters. Many homeowners are choosing to relocate to be nearer to children, grandchildren, or long-time friends.

2. Simplifying Daily Living

Larger homes that once served a busy household can feel overwhelming once the kids are grown. Smaller, thoughtfully designed homes often offer greater comfort and accessibility.

3. Freedom From Work Location

Retirement removes the need to live near the office. That opens the door to moving closer to loved ones, relocating to a favorite destination, or simply finding a more convenient setting.

4. Reducing Ongoing Expenses

Downsizing can mean lower utility bills, property taxes, insurance costs, and maintenance expenses — helping homeowners protect their retirement income.

The consistent theme? Control. Downsizing allows homeowners to shape their living situation around their future — not their past.

The Financial Factor: Home Equity Is Creating Opportunity

One of the biggest reasons downsizing is more realistic today than many expect is home equity.

After years — or even decades — of ownership, many homeowners have built substantial equity simply through appreciation and paying down their mortgage.

When you stay in a home long term, two powerful financial shifts occur:

-

Property values typically increase over time.

-

Mortgage balances decrease — and may even be fully paid off.

That combination can create significant flexibility. For some homeowners, it may mean purchasing a smaller home outright. For others, it could free up funds to strengthen retirement savings, travel, or reduce monthly obligations.

Every situation is unique, but many homeowners are surprised to learn just how strong their position may be.

How to Know If Downsizing Is Right for You

Downsizing isn’t a one-size-fits-all decision. It’s a personal choice that should align with your goals, finances, and lifestyle preferences.

Here are a few questions worth considering:

-

Does your current home still meet your long-term needs?

-

Are maintenance and repairs becoming more of a burden?

-

Would you benefit from being closer to family or amenities?

-

Could your home equity help strengthen your retirement plans?

The first step isn’t putting a sign in the yard. It’s gathering information.

Understanding your home’s current value, your equity position, and what housing options exist locally can give you clarity — without pressure.

Downsizing on Your Terms

Letting go of a home filled with memories is never purely a financial decision. It’s emotional. It’s personal. And it deserves thoughtful guidance.

At CENTURY 21 Jordan-Link & Company, we help homeowners explore their options with clarity and confidence. Whether you’re ready to move this year or simply planning ahead, having a trusted local expert by your side makes the process easier.

Retirement should feel exciting — not overwhelming.

If you’re starting to think about what the next chapter looks like, let’s have a conversation. We’ll review your home’s value, discuss your goals, and map out a strategy that supports your future.

Reach out today to explore what your equity — and your next move — could make possible.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link