Hearing talk about home prices falling can be unsettling—especially when headlines make it sound like values are dropping everywhere. But here’s what homeowners need to know: while a few local markets have seen small dips, home prices are not falling nationally.

In fact, most of the country is still seeing prices rise.

What the National Data Really Shows

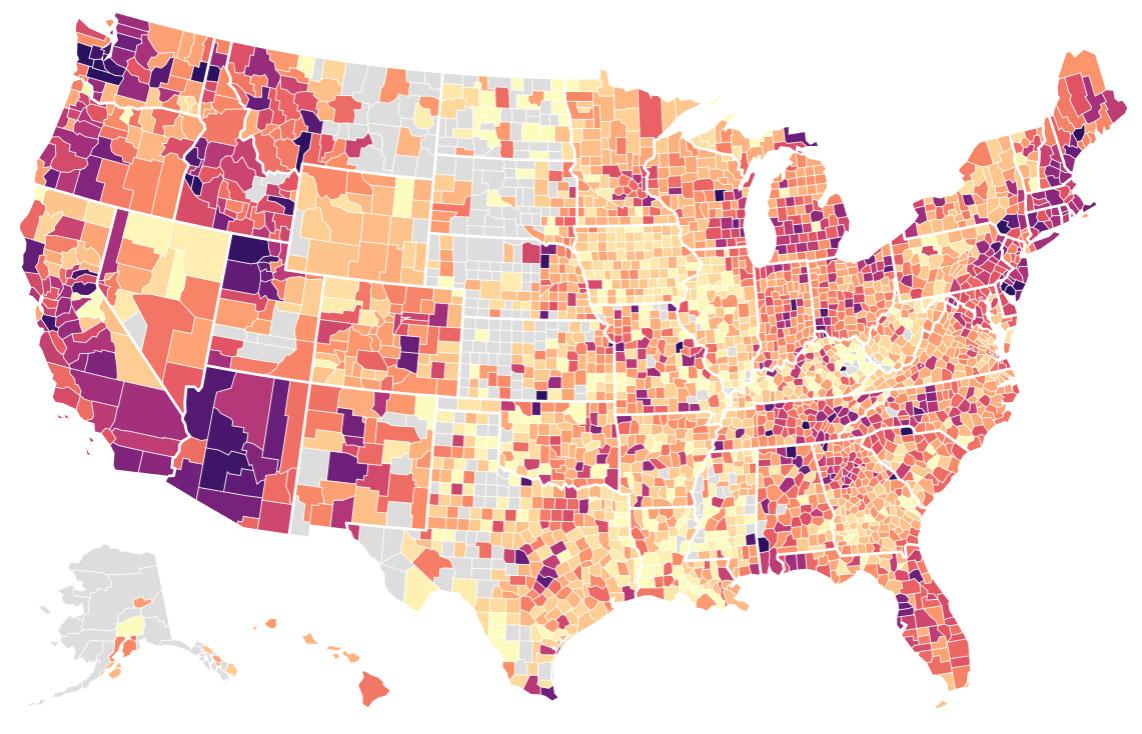

According to year-over-year data from the Federal Housing Finance Agency (FHFA), the majority of states continue to experience price appreciation.

That data tells an important story:

-

Most states are seeing price growth, not declines

-

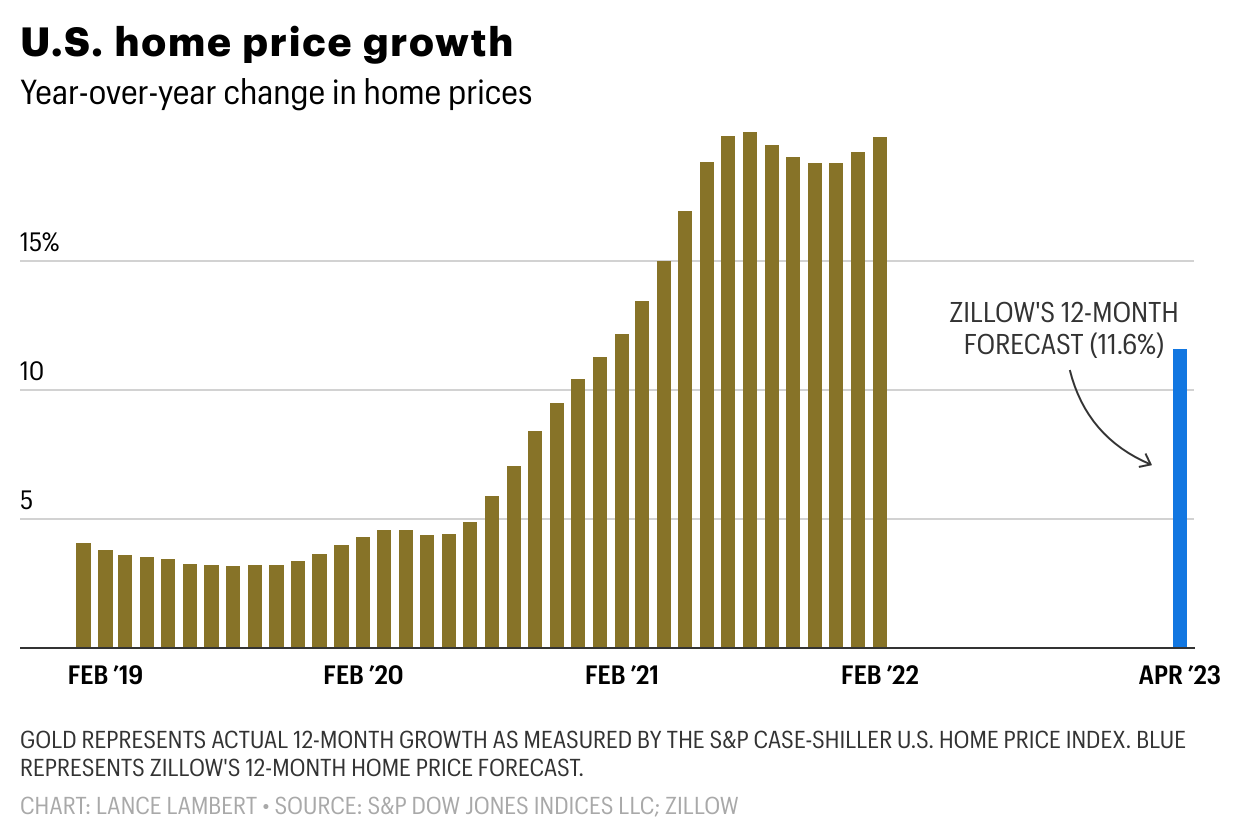

Gains are smaller than the pandemic boom years—but still positive

-

Price moderation ≠ price collapse

Nationally, the National Association of Realtors (NAR) reports that home prices are up 2.1% compared to last year.

That’s not what grabs headlines—but it’s what the data actually shows.

Why the Headlines Feel Scarier Than Reality

Yes, there are a handful of states where prices have dipped slightly (often highlighted in orange on housing maps). But here’s the important context:

-

Those declines range from about -0.1% to -2%

-

They’re localized, not nationwide

-

They’re happening primarily in markets that saw unsustainable price spikes during the pandemic

In other words, this isn’t a crash. It’s normalization.

Markets that rose too far, too fast were always likely to cool off. What we’re seeing now is a leveling—not a collapse.

Most Homeowners Still Have Strong Equity

To put things further into perspective, data from Zillow shows just how resilient homeowner equity really is:

-

Only about 4% of homes are worth less than what the owner paid

-

96% of homeowners are still in a positive equity position

When you zoom out, the picture becomes even clearer.

Over the past five years, national home prices are up nearly 49%, with double-digit growth in almost every market during that time. That’s why, when looking at longer-term data, there’s virtually no orange on the map.

Small, short-term dips are easily absorbed when prices have risen that much overall.

What This Means for You as a Homeowner

The takeaway is simple:

-

Home prices are not crashing

-

Headlines often exaggerate isolated market corrections

-

Most homeowners are still sitting on substantial gains

-

A small dip in certain markets does not signal broader trouble

Real estate is hyperlocal. What matters most is what’s happening in your specific market, not national clickbait headlines.

Bottom Line

If you’re hearing talk about falling prices or market crashes, a closer look at the data tells a much calmer story. Most of the country is still seeing prices rise, and for the vast majority of homeowners, long-term appreciation far outweighs any recent softening.

If you want a clear picture of what’s happening with your home’s value, connecting with a local real estate expert can help you understand the numbers that actually matter.

FAQ

Are home prices falling across the U.S.?

No. Most states are still seeing year-over-year price growth, according to FHFA and NAR data.

Why do headlines say prices are dropping?

Headlines focus on a few local markets with small declines, often ignoring broader national trends.

Should homeowners be worried about losing equity?

Most homeowners have significant equity. About 96% of homes are still worth more than what owners paid.

Is this a housing market crash?

No. This is market normalization after rapid pandemic-era price growth, not a crash.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link