Foreclosure Trends: A Comprehensive Analysis

Introduction

In recent times, the real estate market has been under the microscope, with particular attention paid to foreclosure activities. Amidst swirling headlines and the buzz of speculation, it’s crucial to dissect the data and understand the real trends in foreclosure activities. This article aims to provide a thorough analysis, debunking common misconceptions and offering a clearer picture of the current state of foreclosures in the housing market.

Foreclosure Activity: Beyond the Headlines

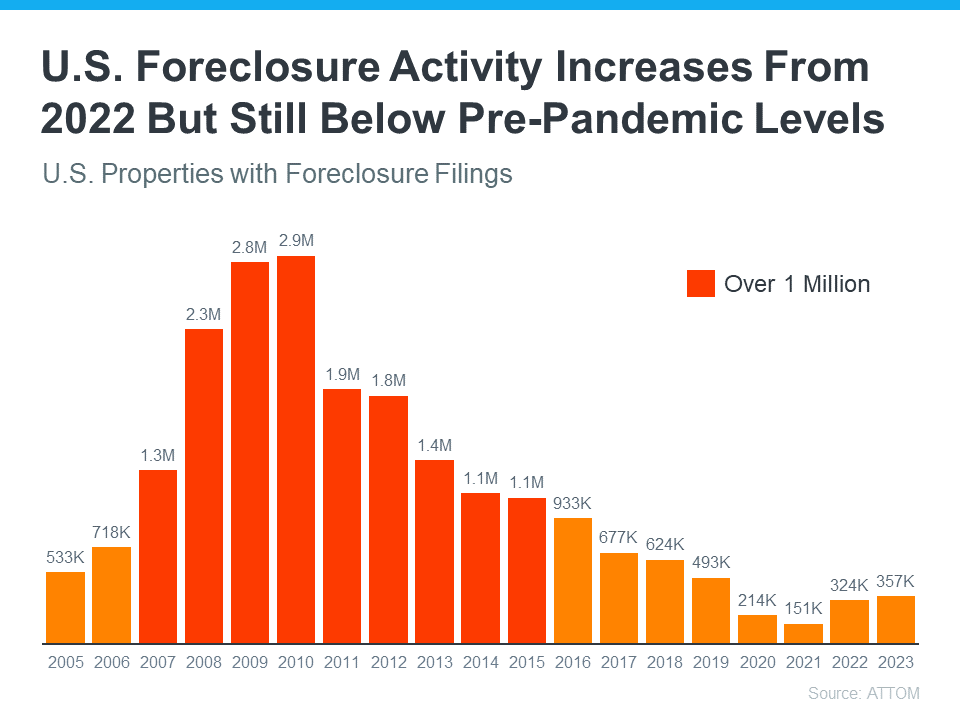

The narrative surrounding an apparent surge in foreclosure activities requires a nuanced examination. It’s essential to distinguish between sensationalized reporting and the actual dynamics at play. A closer look at the data reveals that while there has been a nominal increase in foreclosure filings, the context dramatically alters the interpretation of these figures.

Historical Context and Misleading Comparisons

The comparison of current foreclosure rates to those during the pandemic-induced lows paints an incomplete picture. The pandemic era was characterized by unprecedented government interventions, including moratoriums and forbearance programs, which temporarily suppressed foreclosure activities to historical lows. As these measures phased out, a correction was naturally anticipated.

Long-term Trends vs. Short-term Fluctuations

A comprehensive analysis involves juxtaposing current foreclosure activities against a broader historical backdrop. This approach demystifies the perceived surge and illustrates that foreclosure rates remain significantly below the long-term averages, especially when contrasted with the pre-2008 housing crisis levels.

Analyzing the Data

The real estate market has exhibited resilience, with foreclosure activities not only stabilizing but also maintaining a trajectory well below the alarmist forecasts. This stabilization is attributed to several key factors:

- Increased Homeowner Equity: The majority of homeowners have accumulated significant equity in their properties, providing a buffer against foreclosure.

- Low Delinquency Rates: Despite economic uncertainties, delinquency rates have remained low, indicating a healthy mortgage landscape.

- Stronger Borrower Profiles: Today’s borrowers are better qualified, with stringent lending standards ensuring a robust vetting process.

The Future of Foreclosure Activity

Looking ahead, the data suggests a stable real estate market, with foreclosure activities expected to normalize within the historical averages. This normalization is not indicative of a crisis but rather a return to pre-pandemic operational levels.

Conclusion

The discourse around foreclosure activities necessitates a departure from sensationalism towards a data-driven analysis. The evidence clearly indicates that the market is far from a foreclosure crisis. Instead, it is moving towards equilibrium, characterized by healthy foreclosure activities within expected ranges. For those navigating the housing market, understanding these trends is crucial for making informed decisions, free from the distortions of headline-driven panic.

In essence, the real estate market continues to demonstrate strength and resilience, with foreclosure activities reflecting a natural adjustment rather than a systemic failure. This analysis not only provides clarity but also reassures stakeholders of the market’s underlying stability.

Recommended External Sources:

- ATTOM Data Solutions: For detailed foreclosure and housing market data. Visit ATTOM

- CoreLogic: For insights on property information, analytics, and mortgage delinquency rates. Visit CoreLogic

- National Association of Realtors (NAR): For reports on housing market trends and forecasts. Visit NAR

- Consumer Financial Protection Bureau (CFPB): For information on mortgage assistance and foreclosure prevention resources. Visit CFPB

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link