Overview of California’s Real Estate Climate

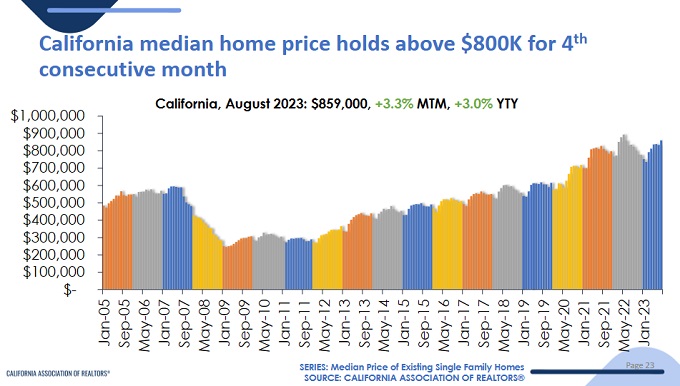

In a dynamic turn of events, the latest statistics from CAR (California Association of Realtors) suggest a potential cessation of the downward trend witnessed in the housing sector. While December 2023 witnessed a slump in prices, with Federal rate hikes seemingly taking a backseat, it may soon be the prime time for buyers to make their move.

However, a significant factor restricting buyers is the current state of low affordability, even as certain regions like the Bay Area observed a hike in prices during the same period.

Anticipated Home Sales and Prices in the Golden State

According to CAR, there is an anticipated surge in home sales by an impressive 22.9%, potentially reaching 327,100 units in the upcoming year. Alongside, the projection for home price growth stands at 6.2% in 2024, elevating the average home price to approximately $860,300.

These predictions stem from the prevailing housing shortage, which is expected to further drive the prices up. But while the mortgage rates might experience a marginal decrease in 2024, it might not suffice in tempting homeowners to sell. It seems they might wait until 2025 for substantial rate reductions, which would ideally boost the Californian economy, triggering more purchases.

One major deterrent continues to be the escalated home prices combined with hefty mortgage payments, which inadvertently propel rent prices, further intensifying inflation.

Insights from CAR’s Senior VP and Chief Economist

CAR’s Senior Vice President and Chief Economist, Jordan Levine, emphasized that the looming economic softening in 2024 could lead the Federal Reserve Bank to adopt a more relaxed monetary stance. Consequently, mortgage rates might observe a consistent downward trend, potentially averaging in the mid-5% range by the end of 2024.

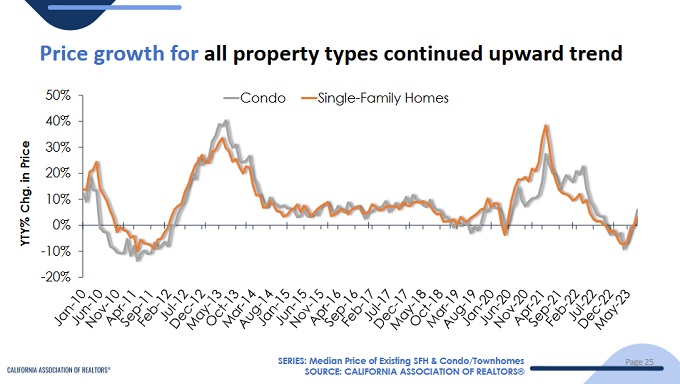

However, the present scenario paints a contrasting picture. CAR’s data highlights a persistent upward pressure on housing prices, given the decline in active listings. Moreover, the extended phase of high mortgage rates compels many homeowners to refrain from selling, thus having to bear with increased mortgage payments. This becomes an escalating concern amidst the inflation-aware segment.

Southern California’s Price Trends

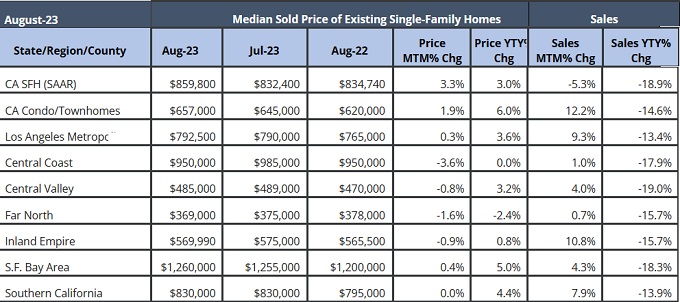

Southern California remains steady, with house prices retaining their position from July. Still, a noteworthy mention is the Bay Area, which saw a 0.4% price ascension. A comprehensive breakdown reveals:

- San Diego: House prices saw a 3.2% rise, touching the $1,000,000 mark.

- Orange County: A subtle 0.8% increase, leading to prices averaging at $1,310,000.

- Los Angeles County: The median price achieved was $888,000, alongside a 5.6% sale growth in August.

- San Bernardino: Experienced a 2.1% price boost, settling at a median value of $495,000.

Inventory Dynamics

There’s an evident reduction in active listings at the state level, consecutively for five months. The year-over-year decrease for the last four months stands at 20%. Particularly, active home listings witnessed a substantial drop in Alameda (-54.0%), Mono (-50.9%), and Contra Costa (-48.5%).

In terms of price realization, sellers are getting closer to their asking price, as proven by C.A.R.’s statewide sales-price-to-list-price ratio, which was 100% in August 2023, a notable increase from 98.4% in August 2022.

The Rental Perspective

While the home resales market narrates one story, the rental market sings a different tune. Rental property investors, provided they make well-informed choices, are presented with a unique opportunity to recoup their investments.

For a more extensive exploration on the Californian rental market, trends, insights, and valuable tips, we recommend browsing the ManageCasa Blog. There, one can also discover the top-ranking cities for rental property investments and acquaint themselves with proficient property management services.

Concluding Thoughts

The future of California’s housing market remains, as always, in a state of flux, influenced by various internal and external factors. From potential FED rate hikes and mortgage payment trajectories to the ongoing housing shortage and changing global economic conditions, numerous elements will shape the state’s real estate trajectory in the coming years. Monitoring these trends closely will be essential for both buyers and sellers looking to make informed decisions in the Golden State’s dynamic housing market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link